Taxes on Casino Winnings in India

Won a Jackpot? Here’s what the taxes look like in India!Winning big in casino sounds appealing, until you have to file for taxes. The paperwork, the complicN8 Login समस्या और समाधानations, and all the numbers can be confusing. And this is why, we came up with a simple guide for desi iGamers - here’s everything you need to know about Taxes on Casino Winnings in India.

Do You Have to Pay Taxes on Casino N8 Casino Bonus Offers – Claim Rewards in India Winnings in India?

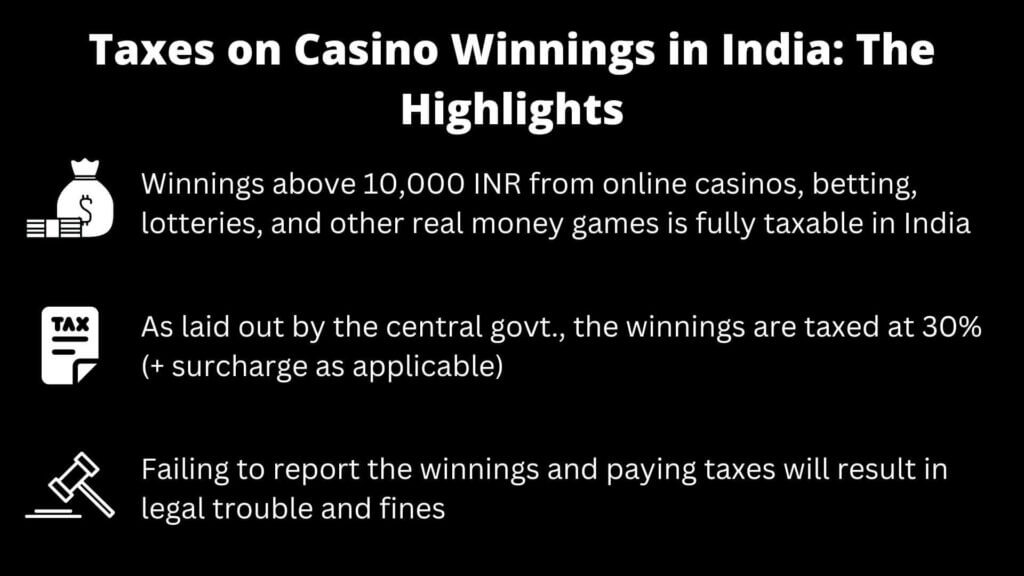

Yes, you have to pay taxes if you win ANYTHING above 10,000 INR – regardless of its source, i.e. online or offline. These winnings need to be declared iN8बोनस ऑफ़र – रजिस्टर करें और जीतेंn the tax form that is filled yearly.

The Income Tax Act of 1961 mentions that all the real money games are subject to 31.2% tax. Interestingly, this includes card games, betting on sports, N8 Live Casino India – Play Real Games Onlinelottery, crossword puzzles, and more.

Even though India has a federal government structure, the taxes on gambling are imposed by the central government, so they’re uniform throughN8 Live Casino – India’s Premier Online Casinoout the country.

Not reporting winnings may result in heavy fines, penalties, and legal trouble – so it’s best to declare the winnings and pay taxes.&N8 Casino Withdrawal – Instant & Securenbsp;

What Winning Amount Do You Have to Report in India?

Regardless of the operator’s location, players have to declare all their real money winnings in the annual tax forms. Resident and non-resident (in caseN8 Game – Top Online Casino in India the winnings come from India). Every winner, who has won a reward of more than 10,000 INR, needs to pay the 30% tax.

Casinos and other related entities that legally operate in the country, usually cut 30% TDS (Tax DedN8 Casino – Trusted Indian Online Platformucted at Source) before the rewards get to the winner. Operators based overseas do not have to pay taxes to the Indian governN8 पर Cricket Betting: IPL 2025 में भाग लेंment.

Is there any surcharge on casino winnings?

The tax structure in India is progressive, this means ‘the more you win, the more you pay’. This applies to winnings from casino, lotteries, betting, and all the real money gaN8 Live Casino – India’s Premier Online Casinomes.

While winning a multi-million jackpot is a rare occasion, the winner might fall into the high-income slabs, and this attraUwin N8 Casino – Top Indian Online Casinocts direct surcharges.

Depending on the amount won from gambling, here’s what the surcharge looks like:

- Over 50 lakhs – 10% surcharge (the total tax would be 33%)

- Over 1 crore – 15% surcharge (the total tax would be 34.5%)

Further, winners also have to pay a surcharge known as ‘Health and Education Cess’ of 4%, which takes your total tax to 31.2%.

Are there any indirect taxes on casino winnings?

Yes, the GST (Goods & Service Tax) is applicable on casinos, sports betting, etc., under the ‘entertainment’ category. However, players and winners need not worry N8 Login समस्या और समाधानabout this tax, since it’s for the operators.

As far as operators are concerned, currently there have been debates about increasing the GST to 28% for games of skill as well as N8: भारत का सबसे भरोसेमंद गेमिंग प्लेटफॉर्मgames of chance. Further, the tax may be charged on the Gross Sales Value rather than Gross Gaming Revenue. This decision is still being debated and reviewed.

In any case, players need not worry about the GST, as they do not have to deal with it (at least directly). The ‘VAT’ is already added to the final price of the producN8 Download – Indian Casino Appts and services offered by the operator.

How an N8 Casino Bonus Offers – Claim Rewards in India d Where to Report Your Winnings in India?

Thanks to the COVID-19 pandemic, most of the give and take happens online – so your income tax can be filed on N8 Casino Bonus Offers – Claim Rewards in India line before the financial year endsN8वैध है या नहीं? – सच का पता लगाएँ.

As a prerequisite, you will have to link your Aadhar Card and PAN Card. The casino winnings are to be declared under “IN8 Download – Indian Casino Appncome from other sources”.

- You can appr N8 Casino Bonus Offers – Claim Rewards in India oach a Chartered Accountant or Tax Consultant to do the job for you

- You can file for taxes yourself through the government portal (if you know how to)

- In case your taxes are already deducted at source, keep a proof, that is, the receipt

In case of offshore casinos, the TDS is not deducted, and players receive the full amount of the rewards. Now, even though this is not really trackable, the responsibilN8निकासी प्रक्रिया – तेज़ और सुरक्षितity lies on the winner to report the winnings honestly and pay the taxes. It is advisable to pay the taxes to avoid legal complications with the tax auN8 Casino Withdrawal – Instant & Securethorities.

Note that your losses cannot be claimed as they are not tax-deductible.

Another note – Rewards above 10,000 INR are taxable at the rates discussed above.

For full details, check out the section 115BB of the Income Tax Act.

Big Rewards = Big Taxes

Here’s the thing – the tax rules are a little outdated. However, they are generalized and N8 Casino APK Download – Latest Version for Android‘all-encompassing’. As they’re central laws, they’re uniform throughout the country

Let’s recap everything we’ve learned so far:

- Winnings above 10,000 INR are taxable and need to be declared in the annual tax form

- Depending on the amount won, there can be an additional surcharge

- In case the winner receives the entire reward amount, it’s the winner’s responsibility to report the rewards and pay taxes

- Losses incurred while gambling are not tax-deductible, and hence cannot be claimed

On that note, we want to add that it’s necessary to play at fully licenced and regulated casinos.

Why?

Because it avoids unnecessary trouble. Reputed casinos are less likely to get you into trouble or default on payments. You can seek legal N8ग्राहक सहायता – 24x7 उपलब्धhelp if you’re scammed.

We have compiled a list of some of the top-rated casinos, that are licenced. You can check out our unbiased reviews before you bet on it!